For all the diversity of financial markets in the modern world, the London Stock Exchange (LSE) is one of five indisputable leaders, the listing on which is seen by most public companies as the height of ambition and the proof of success. Until recently, Russian companies have not been an exception to this rule. Securities issued by Russian companies are sufficiently represented on the London Stock Exchange to provide an objective idea of the state and prospects of Russia’s major businesses. So what has the London mirror reflected?

In 2006, the then-state-controlled Rosneft oil company launched its initial public offering (IPO) after placing nearly 15 percent of its stock on the LSE. The IPO proved to be successful for Rosneft despite the fact that Yukos was accusing the oil company of having expropriated its key operational assets. Putin was pleased. Since then, however, the market capitalization of Rosneft has been gradually decreasing, and the company’s stock is currently trading at less than half their price at the initial public offering, despite the fact that in 2015, Rosneft reached a settlement with Yukos.

In 2007, impressed by Rosneft’s initial success, state-controlled Vneshtorgbank (VTB) entered the market by placing 22.5 percent of its stock in London. For a few months after that, VTB’s shares traded higher than their initial IPO level. Later, however, their market value dropped and has never reached its IPO level since. In October 2011, VTB’s Chairman and CEO Andrey Kostin declared the IPO a failure. The fact that more than 120,000 private individuals had acquired the Bank’s shares at the initial public offering only made the situation worse. In 2012, on Putin’s direct orders, VTB had to buy shares back from “people’s” shareholders for the IPO price. It is also worth mentioning that only 434 people invested their money again in VTB after the buyback.

The story of NOVATEK, Russia’s second largest (after Gazprom) and formally independent gas producer can at first appear more successful. NOVATEK launched its initial public offering in 2005 by placing 17.3 percent of its stock in London. Over the last 10 years, its stock value has increased more than fivefold. To an uninformed third party this might seem like an incredible success story. However, NOVATEK’s secret is quite simple: in 2006, about 20 percent of its shares were sold to the top management of state-controlled Gazprom. Furthermore, in 2009, Putin’s close friend Gennady Timchenko acquired 13.13 percent of the company and later increased his ownership to 23 percent. By an incredible coincidence, in the same 2009 NOVATEK became the largest shareholder in Yamal LNG, that has a license to develop a major gas condensate field in Siberia.

In 2016, the US Department of the Treasury and the White House officially called such “coincidences” corrupt practices. NOVATEK’s stock, however, already dropped 8 percent back in 2014 after the United States had introduced sanctions personally against Mr. Timchenko.

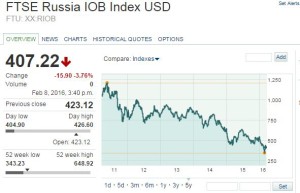

In addition to the “personal” factor represented by major shareholders, the stock value of Russian companies is considerably influenced by political risks posed by the current regime. For example, all Russian companies went down in value when the country’s government made the decision to annex Crimea and send Russian troops to Ukraine.

There is no doubt that the current period of low global prices on raw materials in the context of the financial crisis pushes down stock prices of public companies worldwide—not only in Russia. However, when the situation in Russia was relatively stable, fluctuations in stock value of Russian blue chips were understandable and could be predicted based on the companies’ financial statements prepared according to international standards, as well as on their development plans and strategies. However, in the context of recent statements about possible use of nuclear weapons, that fell into the hands of people whom the global community suspects of thievery, only the most reckless traders would dare to invest in Kremlin-controlled companies. The fact that Chinese banks, major players on the global stock market, have begun withdrawing from Russian assets speaks for itself.