Russian government is making a serious attempt to replenish its federal budget. The lack of funds has two main causes. First, the export of oil and gas has been a main source of income for Russia but prices for these mineral resources have been falling. At the same time, Russia has been unable to raise cheap money in the West because of sanctions imposed in response to the annexation of the Crimea. To address these losses, government is discussing introduction of new taxes and fees, raising rates of existing ones, and improving the collection of taxes and fees.

Russian government is making a serious attempt to replenish its federal budget. The lack of funds has two main causes. First, the export of oil and gas has been a main source of income for Russia but prices for these mineral resources have been falling. At the same time, Russia has been unable to raise cheap money in the West because of sanctions imposed in response to the annexation of the Crimea. To address these losses, government is discussing introduction of new taxes and fees, raising rates of existing ones, and improving the collection of taxes and fees.

A value-added tax (VAT) brings the largest amount of money into the Russian budget. It was put in place in 1992. In those years, the heads of the government were free-market reformers, and the tax procedures, established by the Tax Code of the Russian Federation, are similar to those in Europe. When reselling goods each party pays a tax based on the value that it adds to the cost of the goods or the raw materials. As a result, the tax burden is distributed among all parties of the commodity chain, including the final individual consumer.

To promote export abroad the government set a “zero” rate of VAT for the companies which supply goods or services to foreign countries. However, a taxpayer must prove to tax authorities that he has a right to apply this “zero” rate. This is when taxpayers have problems, especially when they request a refund or offset of VAT. On the one hand, under the law, a tax authority must authorize refund or offset of rightly reclaimed VAT. On the other hand, its task is to increase tax collection – and refunds or offset of VAT certainly do not contribute to that. In 2014, the head of the Federal Tax Service, Mikhail Mishustin, said, “This year we plan to increase revenues from income tax and VAT by 450 billion rubles.”

In recent years the VAT refund rarely happens without participation of law enforcement and the courts. Tax authorities enlist police and the investigative committee in, to check into a company which wants to reclaim VAT. For a taxpayer company it creates a big problem. The law enforcement officers seize documents and sometimes computers in company’s offices. These activities entail suspension of the current operations of the company, and financial losses, at least in the form of lost revenues. The result can be much worse than the potential benefits of the VAT refund. Information about the methods and consequences of inspections spreads rapidly in the business environment. Many businessmen start to doubt if they really want to use their legal right to a VAT refund.

Even if all documents are in order, the tax authority can refuse to refund VAT for other often far-fetched, reasons. For example, the inspectors may find that the supplier of the company is a dummy and did not pay its share of VAT to the state budget. Then the only way for the taxpayer to protect his right to VAT refund is to file a lawsuit. However, legal proceedings are long and costly and, according to Mikhail Mishustin, they are futile in 77% of cases.

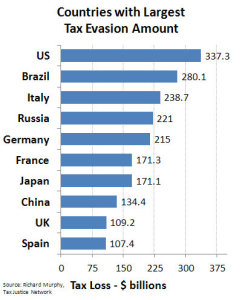

Not all businesses have these problems with the tax authorities though. The process of VAT refund is greatly simplified and accelerated for a company if tax service employees, police officers and judiciary officials have an interest in such a refund. They are the inventors and performers of fraudulent schemes involving the theft of money from the state budget under the guise of tax refund. One example became public through the efforts of Sergei Magnitsky and Bill Browder. In a criminal conspiracy between officers of the Ministry of Internal Affairs and the heads of one of the Moscow tax inspections, 230 million dollars were stolen from the Russian budget in the form of “tax refund.”

Not all businesses have these problems with the tax authorities though. The process of VAT refund is greatly simplified and accelerated for a company if tax service employees, police officers and judiciary officials have an interest in such a refund. They are the inventors and performers of fraudulent schemes involving the theft of money from the state budget under the guise of tax refund. One example became public through the efforts of Sergei Magnitsky and Bill Browder. In a criminal conspiracy between officers of the Ministry of Internal Affairs and the heads of one of the Moscow tax inspections, 230 million dollars were stolen from the Russian budget in the form of “tax refund.”

The Magnitsky case and cases similar to it come at a high cost for the economy of Russia. The issue is not only the amounts of money stolen but also the emigration of honest businessmen who refuse to accept the existing rules of the game, close their companies, and leave the country. Where will the tax revenues for the budget come from if added value is not being created at all?

The misuse of VAT refunds has a negative impact on the economic situation in Russia and its attractiveness to investors but the Kremlin does not see any problem. The government continues discussing what is better: the introduction of a new sales tax or a VAT increase. In the end, it is taxpayers who pay for the war in Ukraine, not those who started it.