The onrushing growth of the Internet resulted in the appearance of new and previously unknown ways to make money. A couple of decades ago nobody could have imagined that it would be possible to buy and sell goods without leaving one’s house, and the notion of e-commerce would only have left one perplexed. The development of technologies made e-commerce accessible for merchants of any size from small farmers to international corporations, but more importantly, it allowed buyers to see “store windows” and make purchases from any corner of the world.

The onrushing growth of the Internet resulted in the appearance of new and previously unknown ways to make money. A couple of decades ago nobody could have imagined that it would be possible to buy and sell goods without leaving one’s house, and the notion of e-commerce would only have left one perplexed. The development of technologies made e-commerce accessible for merchants of any size from small farmers to international corporations, but more importantly, it allowed buyers to see “store windows” and make purchases from any corner of the world.

In 2013, worldwide e-commerce sales reached $1.251 trillion, and in 2014, $1.5 trillion. According to the World Trade Organization (WTO), e-commerce growth rates are currently considerably higher than those of world trade in general. North America and Western Europe had been the leading regions in e-commerce for many years before giving place to markets of the Asia-Pacific region that have recently been developing rapidly. Such giants as Amazon that began operating in 1995 and is considered to be the world’s oldest retail platform, its contemporary eBay that added online auctioning to its services, and of course Chinese Alibaba, a new but fantastically fast-growing online shopping platform are widely regarded as leaders in online retail business.

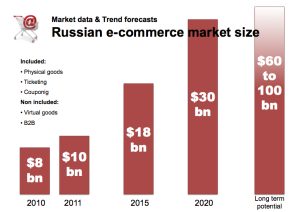

According to analysts, Russia is quickly catching up with the leaders in its online sales and is quite capable of accomplishing, what it took the US and Great Britain 15 to 20 years to do, in a mere 7 to 8 years. Russian e-commerce market grows 20 to 30 percent a year, accounts for less than 1 percent of the country’s GDP and represents around 2 percent of the total retail market. Russia has already surpassed Germany and ranks first in Europe for the number of Internet users (68 million people, or 48 percent). However, the situation with online shoppers is considerably different. In Russia the number of online buyers amounts to 23 million, which constitutes 34 percent of the adult population, whereas in Germany, it reaches 41 million (or 61 percent). By 2020, e-commerce sales in Russia will most likely match those of the UK.

There are currently a few large websites in Russia that specialize in online commerce but it will certainly take them a long time to catch up with major international players due to several systemic problems that do not allow Russian e-commerce to develop steadily. The key problem consists in the existence of a large shadow sector. This problem is caused by the fact that, according to different estimates, 50 to 80 percent of online sales to Russians are paid in cash. This is no surprise because fees charged for banking services and online credit/debit card payments, which constitutes merchants’ additional expenditures, are rather high. Thus, in the  Russian e-commerce, these fees are almost twice as high (2 to 4 percent) as in retail stores (1.5 to 2 percent). For comparison, the cost of the same services in Europe amounts to around 0.6 percent, in China, it fluctuates from 0.35 to 1.4 percent, and in the US, from 1.5 to 2 percent.

Russian e-commerce, these fees are almost twice as high (2 to 4 percent) as in retail stores (1.5 to 2 percent). For comparison, the cost of the same services in Europe amounts to around 0.6 percent, in China, it fluctuates from 0.35 to 1.4 percent, and in the US, from 1.5 to 2 percent.

Another problem consists in the difficulty and sometimes even impossibility for online buyers to return or exchange even poor quality goods. Naturally, online retailers are in no haste to do this, and banks and e-payment systems are not responsible for meeting refund deadlines if purchases are paid for with a credit/debit card or through an e-purse. It can take up to 30 days for the refund to be issued back to the debit or credit card used for payment. It is no surprise that under such circumstances, both merchants and buyers prefer cash payments, and consequently, this revenue remains in the shadow.

Despite the aforementioned problems, for the last five years, the Russian e-commerce market has been witnessing a huge 42.5 percent annual growth. However, 2015 will likely bring a 5 percent decrease in the market’s growth due to the economic crisis in the country. The reason is obvious. For example, a considerable number of home appliances and electronics — most of them foreign-made — are bought online. The ruble’s landslide tumble made these goods more costly, which resulted in a decrease in demand. Russians have switched from shopping in European and US online stores to buying less expensive and often lower-quality goods made in developing countries.

Considering the existing issues of the Russian e-commerce market and an expected decrease in quality of purchased goods, one might assume that the problems of online retail will only grow. And while merchants are trying to make money under rapidly deteriorating market conditions, the Kremlin decided to promote its own “patriotic” Internet where there will be no place for Amazon, eBay or even Alibaba, but where, after waiting in a long line, one will likely be able to buy a used Lada for cash.